FAQ

In case you fill out all details correctly, it takes less than 5 minutes.

If you have already opened a trading account, received your login details by email, submitted your identification documents for account validation, and made a deposit; the next step is to download the platform.

We offer the following trading account types:

SILVER: 1 micro lot is 1,000 units of the base currency

GOLD: 1 standard lot is 100,000 units of the base currency

PLATINUM: 1 standard lot is 100,000 units of the base currency

For further details, please click HERE.

It is $10 for SILVER account, while for GOLD accounts it is $500.

We offer SILVER trading accounts, where 1 micro lot (pip) is equal to 10 USD cents. However, your deposit is always visible in the actual amount, e.g. if you deposit 100 USD, your trading account balance will be 100 USD

Westminter markets offers SILVER and GOLD accounts. However, you can obtain mini lot size trades (10000 units) by reducing your standard account volume to 0,1 (0,1 x 100000 units=10000 units), or by increasing your trade volume to 10 micro lots (10 x 1000 units=10000 units) in micro account type.

Westminter markets offers SILVER and GOLD accounts, but you can obtain nano lot size trades (100 units) by reducing your trade volume to 0,1 in micro account type (1micro lot=1000 units).

Yes, we do. You can request a swap-free Islamic account by following the instructions described HERE

At Westminter markets demo accounts do not have an expiry date, and so you can use them as long as you want. Demo accounts that have been inactive for longer than 90 days from the last login will be closed. However, you can open a new demo account at any time. Please note that maximum 8 active demo accounts are allowed.

It is not possible to change the base currency of your account, however you can open a new account at any time and then specify your preferred base currency.

No, you cannot lose more than the amount you deposited. Should the slippage of a certain currency pair cause a negative balance, it will be reset automatically with your next deposit.

As the bonus amount is part of your equity and can be used for trading, it is possible for you to lose it. However, you do not have to refund it, moreover, according to the Bonus Terms and Conditions, you can receive a new bonus on your new deposit.

Please right click on any of the symbols in the Market Watch that you want to see and choose the Chart Window option. Alternatively, you can drag-and-drop any symbol in the chart window.

We provide leverages between 1:1 – 888:1. The leverage depends on your initial deposit, so please read more details about this HERE

We offer variable spreads that can be as low as 0.5 pip. We have no re-quoting: our clients are given directly the market price that our system receives. You can read more about our spreads and conditions HERE.

The market is open from Sunday 22:05 to Friday 21:50 GMT. However, certain instruments have different trading hours (e.g. CFDs), the details of which you can view here.

yes we do

Margin calculation formula for forex instruments is the following:(Lots * contract size / leverage) where the result is at always in the primary currency of the symbol.

For STANDARD accounts all forex instruments have a contract size of 100 000 units. For MICRO accounts all forex instruments have a contract size of 1 000 units.

For instance, if the base currency for your trading account is USD, your leverage is 1:500 and you are trading 1 lot EURUSD, the margin will be calculated like this:

(1 * 100 000/500) = 200 Euros

Euro is the primary currency of the symbol EURUSD, and because your account is USD, the system automatically converts the 200 EUROS to USD at the actual rate.

The gold/silver margin formula is lots * contract size * market price/ leverage.

The CFDs margin formula is Lots * Contract Size * Opening Price * Margin Percentage.

The swap formula for all forex instruments, including gold and silver, is the following: lots * long or short positions * point size Here is an example for EUR/USD:

Client base currency is USD

1 lot buy EUR/USD

Long = -3.68

Because it is a buy position, the system will take the swap rate for long position, which currently is -3.68

Point size = contract size of a symbol * minimum price fluctuation

EUR/USD point size = 100 000 * 0.00001 = 1

If we apply the given numbers in the formula, it will be 1 * (-3.68) * 1 = -3.68 USD.

So for 1 lot buy EUR/USD, if the position is left overnight, the swap calculation for the client will be -3.68 USD.

Here is an example for gold

Client base currency is USD 1 lot buy gold Long = -2.17

Because it is a buy position, the system will take the long points, which currently is -2.17.

Point size = contract size of a symbol * minimum price fluctuation

Gold point size = 100 * 0.01 = 1

If we apply the given numbers in the formula, it will be 1 * (-2.17) * 1 = -2.17 USD.

So for 1 lot buy gold, if the position is left overnight, the swap calculation for the client will be -2.17 USD.

Please note that if the base currency of the trading account is in EUR (like in the examples above), the swap calculation will be converted from USD to EUR. The result of the swap calculation is always the secondary currency in a symbol, and the system converts it to the base currency of the trading account.

You can calculate your profits with the help of the following formula: (Close price-open price)*Contract size*Lots Example You have a MICRO account (contract size is 1000), and you opened 0.01 lots of EUR/USD. Opening price =1.29887, closing price=1.29906 The calculation would be as follows: (1.29906-1.29887)*1000*0.01= 0.0019 USD (the result is always in the second currency of the currency pair). As you can see, 0.0019 USD is too small a profit to be visible on your platform, as the profit shows 2 decimals.

yes, we do.

Stop loss is an order for closing a previously opened position at a price less profitable for the client than the price at the time of placing the order. Stop loss is a limit point that you set to your order. Once this limit point is reached, your order will be closed. Please note that you need to leave certain distances from the current market price when you set up stop/limit orders.

Using stop loss is useful if you want to minimize your losses when the market goes against you. Stop loss points are always set below the current ASK price on “buy” or above the current BID price on “sell”.

Take profit is an order to close a previously opened position at a price more profitable for the client than the price at the time of placing the order. When the take profit is reached, the order will be closed. Please note that you need to leave certain distances from the current market price when you set up stop/limit orders.

Trailing stop is a type of stop loss order. It is set at a percentage level either below the market price for long positions, or above the market price for short positions. Kindly note that you need to leave certain distances from the current market price when you set up stop/limit orders

Amount of Base Currency*Pips= Value in Quote Currency

Value of 1 pip in EUR/USD= 1 Lot (100 000 €)*0.0001= 10 USD

Value of 1 pip in USD/CHF= 1 Lot (100 000$)*0.0001=10 CHF

Value of 1 pip in EUR/JPY=1 Lot (100 000 €)*0.01= 1000 JPY

The numbers below are per transaction, and you can open an unlimited amount.

GOLD account:

1 lot = 100,000

Minimum trade volume = 0.01

Maximum trade volume = 50

Trading step = 0.01

SILVER account:

1 Lot = 1,000

Minimum trade volume = 0.01

Maximum trade volume = 100

Trading step = 0.01

Please note that the minimum lot size for trading with CFDs is 1 lot.

Yes, we do. You are free to hedge your positions on your trading account. Hedging takes place when you open a long and a short position on the same instrument simultaneously. When you open a Buy and Sell position on the same instrument and in the same lot size, the margin is 0. However, when you open a Buy and a Sell position of CFD of the same type and lot size, the margin is only needed once.

Leverage is the multiplication of your balance. This allows you to open bigger trading positions since the margin required will be lowered according to the leverage you have chosen. Even though with leverage you can make a bigger profit, there is also a risk of having a bigger loss because the positions you open will be of higher volume (lot size). Example: Your trading capital is10.000EUR

The leverage chosen is 100:1

For a GOLD trading account this means 100*10.000 = 1.000.000EUR

On EURUSD long position opening at 1.3055, position closing at 1.3155

The difference is 0.0100 pips thus 1.000.000*0.0100 = 10.000 USD this is the profit you made.

You can change the leverage under the tab My Account -> Change Leverage in our Members Area. This method of changing leverage is instant. Alternatively, you can send us a request to have your leverage changed via email to [email protected]

The profit calculation is as follows:

(Close Price-Open Price)*Lots*Contract Size

The lot size on every CFD differs.

Yes, you can, up to a maximum of 8 active trading accounts. It is preferable, however, to use the same personal details as for your other trading account(s). You can register for an additional account in the Members Area with 1 click.

Accounts with zero balance will be archived after a period of ninety (90) calendar days.

An account shall be deemed as dormant from the last day of the ninety (90) calendar days during which there has been no activity (trading/withdrawals/deposits) in the account. All remaining bonuses, promotional credits, XMPs will be automatically removed from dormant accounts. A dormant account will be charged with a monthly fee of USD 5 (five United States dollars) or the full amount of the free balance in the account if the free balance is less than USD 5 (five United States dollars). There will be no charge if the free balance in the account is zero.

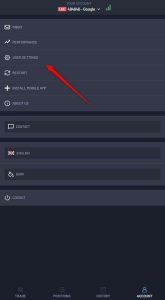

Click on Account

Click on user settings

Click on security tab

Click on Delete Account

After that step, an account is permanently removed.

Upon a user’s request for data deletion, all of their associated information is thoroughly removed from our systems, with the exception of their Email, Name, and Surname. These particular details are retained in our database informing only when the user requested deletion of their account for the duration of the app’s current existence, ensuring continuity and compliance with our data retention policies. This data can be removed on demand.

There is no maximum amount you can trade online, but there is a maximum number of 50 standard lots you can trade online at streaming prices for GOLD accounts and 100 micro lots for SILVER accounts. The maximum number of positions open at the same time, and for all account types, is 200. If you want to deal in an amount bigger than your account type’s maximum lots, you may break your trade into smaller sizes.

When placing a trade in the spot forex market, the actual value date is two days forward, for instance, a deal done on Thursday is for value Monday, a deal done on Friday is for value Tuesday, and so on. On Wednesday, the rollover amount is tripled to compensate for the following weekend (during which time rollover is not charged because trading is stopped at weekends).

According to the recent Dodd-Frank Act passed by the US Congress, the CFTC (Commodity Futures Trading Commission) no longer allows us to let US residents open trading accounts with us. We apologize for the inconvenience.

No, we do not.

No, you can’t. Please register for an additional account in the Members Area.

One-click trading allows you to open positions with just one click. When you want to close a position, however, one click does not work and you will need to close it manually. To enable one-click trading on the left corner of your chart, you will find an arrow. By clicking that arrow you enable one-click trading and a window appears on the left corner of the chart.

Supporting documents are:

A color copy of valid passport or other official identification document issued by authorities (e.g. driver’s license, identity card, etc). The identification document must contain the client’s full name, an issue or expiry date, the client’s place and date of birth or tax identification number and the client’s signature.

A recent utility bill (e.g. electricity, gas, water, phone, oil, Internet and/or cable TV connection, bank account statement) dated within the last 6 months and confirming your registered address.

Yes, you do. In order to start trading and to be able to make withdrawals from your account, your account has to be validated, therefore you must provide a recent utility bill (e.g. electricity, gas, water, phone, oil, Internet and/or cable TV connection) or bank account statement not older than 6 months, and confirming your registered address.

Yes, you can. It is preferable, however, to use the same personal details as for your other trading account(s). Kindly note that the maximum number of accounts allowed per client is 8.

No, your new account will be validated automatically, as long as you will use the same personal /contact details as for your previous account.

If you wish to update your email address or your residential address, please send an email to [email protected] from your registered email address, along with your new proof of address.

Currently, you can choose from the following options to deposit and withdraw funds: bank wire transfer, local bank transfer, and other payment methods.

In order to withdraw funds, your trading account must be validated. This means that first you need to upload your documents in our Members Area: Proof of Identity (ID, passport, driving license) and Proof of Residency (utility bill, telephone/Internet/TV bill or bank statement), which include your address and your name and can’t be older than 6 months. Once you receive confirmation from our Validation Department that your account has been validated, you can request the funds withdrawal by logging in to the Members Area, select the Withdrawal tab and send us a withdrawal request. It is only possible to send your withdrawal back to the original source of deposit. All withdrawals are processed by our Finance Desk within 24 hours on business days.

Yes, you can, if at the moment of payment your free margin exceeds the amount specified in the withdrawal instruction, including all payment charges. Free margin is calculated as equity less necessary margin (required to maintain an open position). If you do not have sufficient free margin in your trading account, the system will not accept your request and you will need to lower the amount

It depends on the country the money is sent to. Bank wires to some countries may take up to 5 working days.

Your withdrawal request is processed by our Finance Desk within 24 hours.

All deposits are instant, except for the bank wire transfer. All withdrawals are processed by our Finance Desk in 24 hours on business days.

We offer a wide range of payment options for deposits: by bank wire transfer, local bank transfer, and other payment methods.

As soon as you open a trading account, you can log in to our Members Area, select a payment method of your preference on the Deposits page, and follow the instructions given.

We do not charge any fees for our deposit/withdrawal options. For instance, if you deposit USD 100 by Neteller and then withdraw USD 100, you will see the full amount of USD 100 in your Neteller account as we cover all transaction fees both ways for you.

No, this is not possible. It is forbidden to transfer funds between different clients’ accounts and involve any third parties.on Content

As we are a regulated company, we do not accept deposits/withdrawals made by third parties. Your deposit can only be made from your own account, and the withdrawal has to go back to the source where the deposit was made.

Yes, this is possible. You can request an internal transfer between two trading accounts, but only if both accounts have been opened under your name and if both trading accounts have been validated. If the base currency is different, the amount will be converted. Internal transfer can be requested in the Members Area, and it is instantly processed.

Open the terminal window by pressing Ctrl+T on your keyboard, and select the Account History tab. Right click to enable the context menu, which will allow you to save your trading history as an .html file so that you can later view it when you log out of the trading platform.

Yes, you can. All our trading platforms support the use of EAs.

First check if trading is allowed by going to Tools -> Options -> Experts tab -> Allow live trading. Then make sure that the expert advisor button on the main tool bar is pressed. You should be able to see a smiley face in the top right-hand corner of your chart which shows that you have activated your EA correctly. If everything is all right, but the EA still does not trade, see your log files via the Experts tab in the Terminal window (you should be able to see what error occurs). You can also email us for further assistance at [email protected].

We separate standard trades from micro trades (1volume in standard account = 100 000 units, 1volume in micro account = 1000 units). This is why you should search in your market watch window for the symbols with Micro extension (e.g. EUR/USD micro instead EUR/USD), right-click and choose Show all. The other “grayed” symbols are used by the platform to calculate oil prices. Right-click these “grayed” symbols, and choose the Hide option to avoid any confusion.

No, you can’t. The time zone of our trading servers is always GMT+2 winter time and GMT+3 summer time. GMT time setting avoids having small candlesticks on Sundays and therefore allows the running of technical analysis and backtesting to go more smoothly and straightforward.

We separate standard trades from micro trades (1volume in standard account = 100 000 units, 1volume in micro account = 1000 units). This is why you should search in the Market Watch window for the symbols with “micro” extension (e.g. EUR/USD micro instead EUR/USD), right-click and choose Show all. The other “grayed” symbols are used by the platform to calculate oil prices. Right-click these “grayed” symbols, and choose the Hide option to avoid any confusion.

Every buy order is open at ASK price and closed at BID price, and every sell order is open on BID price and closed at ASK price. By default, you are only able to see the BID line on your chart. In order to see the ASK line, right click the particular chart -> Properties -> Common-> and tick the Show ASK line.

Supporting documents are: A color copy of valid passport or other official identification document issued by authorities (e.g. driver’s license, identity card, etc). The identification document must contain the client’s full name, an issue or expiry date, the client’s place and date of birth or tax identification number and the client’s signature. A recent utility bill (e.g. electricity, gas, water, phone, oil, Internet and/or cable TV connection, bank account statement) dated within the last 6 months and confirming your registered address.

Yes, you do. In order to start trading and to be able to make withdrawals from your account, your account has to be validated, therefore you must provide a recent utility bill (e.g. electricity, gas, water, phone, oil, Internet and/or cable TV connection) or bank account statement not older than 6 months, and confirming your registered address.

Yes, you can. It is preferable, however, to use the same personal details as for your other trading account(s). Kindly note that the maximum number of accounts allowed per client is 8.

No, your new account will be validated automatically, as long as you will use the same personal /contact details as for your previous account.

If you wish to update your email address or your residential address, please send an email to [email protected] from your registered email address, along with your new proof of address.

Currently, you can choose from the following options to deposit and withdraw funds: bank wire transfer, local bank transfer, and other payment methods.

You can deposit money in any currency and it will be automatically converted into the base currency of your account, by Bristol Markets prevailing inter-bank price.

In order to withdraw funds, your trading account must be validated. This means that first you need to upload your documents in our Members Area: Proof of Identity (ID, passport, driving license) and Proof of Residency (utility bill, telephone/Internet/TV bill or bank statement), which include your address and your name and can’t be older than 6 months. Once you receive confirmation from our Validation Department that your account has been validated, you can request the funds withdrawal by logging in to the Members Area, select the Withdrawal tab and send us a withdrawal request. It is only possible to send your withdrawal back to the original source of deposit. All withdrawals are processed by our Finance Desk within 24 hours on business days.

Yes, you can, if at the moment of payment your free margin exceeds the amount specified in the withdrawal instruction, including all payment charges. Free margin is calculated as equity less necessary margin (required to maintain an open position). If you do not have sufficient free margin in your trading account, the system will not accept your request and you will need to lower the amount

It depends on the country the money is sent to. Bank wires to some countries may take up to 5 working days.

Your withdrawal request is processed by our Finance Desk within 24 hours.

All deposits are instant, except for the bank wire transfer. All withdrawals are processed by our Finance Desk in 24 hours on business days.

We offer a wide range of payment options for deposits: by bank wire transfer, local bank transfer, and other payment methods. As soon as you open a trading account, you can log in to our Members Area, select a payment method of your preference on the Deposits page, and follow the instructions given.

We do not charge any fees for our deposit/withdrawal options. For instance, if you deposit USD 100 by Neteller and then withdraw USD 100, you will see the full amount of USD 100 in your Neteller account as we cover all transaction fees both ways for you.

No, this is not possible. It is forbidden to transfer funds between different clients’ accounts and involve any third parties.

As we are a regulated company, we do not accept deposits/withdrawals made by third parties. Your deposit can only be made from your own account, and the withdrawal has to go back to the source where the deposit was made.

Yes, this is possible. You can request an internal transfer between two trading accounts, but only if both accounts have been opened under your name and if both trading accounts have been validated. If the base currency is different, the amount will be converted. Internal transfer can be requested in the Members Area, and it is instantly processed.

While all features and functions of a real account are also available for a demo account, you should keep in mind that simulation cannot replicate real trading market conditions. One relevant difference is that the volume executed through the simulation does not affect the market; while in real trading volumes have effect on the market, especially when the deal size is large. The speed of execution is the same for real trading accounts as for the Bristol markets demo accounts. Moreover, users can have a very different psychological profile depending on whether they trade with demo or real accounts. This aspect may impact the evaluation performed with the demo account. We advise you to be cautious and avoid complacency about any conclusion that you may draw from using a demo account.

Open the terminal window by pressing Ctrl+T on your keyboard, and select the Account History tab. Right click to enable the context menu, which will allow you to save your trading history as an .html file so that you can later view it when you log out of the trading platform.

Yes, you can. All our trading platforms support the use of EAs.

Save your expert advisor in the Bristol Markets Trader App directory on your computer: C:Program Files – MetaTrader – Bristol markets – experts. Then restart Bristol Markets Trader App. The expert advisor file should appear in the navigator window of Bristol Markets Trader App. Left click on it and drop-and-drag it onto the chart of the currency that you would like the expert advisor to trade on

First check if trading is allowed by going to Tools -> Options -> Experts tab -> Allow live trading. Then make sure that the expert advisor button on the main tool bar is pressed. You should be able to see a smiley face in the top right-hand corner of your chart which shows that you have activated your EA correctly. If everything is all right, but the EA still does not trade, see your log files via the Experts tab in the Terminal window (you should be able to see what error occurs). You can also email us for further assistance at [email protected].

We separate standard trades from micro trades (1volume in standard account = 100 000 units, 1volume in micro account = 1000 units). This is why you should search in your market watch window for the symbols with Micro extension (e.g. EUR/USD micro instead EUR/USD), right-click and choose Show all. The other “grayed” symbols are used by the platform to calculate oil prices. Right-click these “grayed” symbols, and choose the Hide option to avoid any confusion.

Log in to your Bristol Markets Trader App platform -> Market watch window -> right click -> Show all -> scroll down and you will be able to see all instruments available for trading.

No, you can’t. The time zone of our trading servers is always GMT+2 winter time and GMT+3 summer time. GMT time setting avoids having small candlesticks on Sundays and therefore allows the running of technical analysis and backtesting to go more smoothly and straightforward.

We separate standard trades from micro trades (1volume in standard account = 100 000 units, 1volume in micro account = 1000 units). This is why you should search in the Market Watch window for the symbols with “micro” extension (e.g. EUR/USD micro instead EUR/USD), right-click and choose Show all. The other “grayed” symbols are used by the platform to calculate oil prices. Right-click these “grayed” symbols, and choose the Hide option to avoid any confusion.

Every buy order is open at ASK price and closed at BID price, and every sell order is open on BID price and closed at ASK price. By default, you are only able to see the BID line on your chart. In order to see the ASK line, right click the particular chart -> Properties -> Common-> and tick the Show ASK line.